Answering the question, “How should I be paying for college?” is similar to “How to get fit?” or “How to learn a new language?”. In other words, these questions are broad in nature and everyone can formulate a different answer based off of their own understandings.

That being said, parents and students have devised their own answers to this particular question for many years. We have consolidated the best of their journey to give you a surefire roadmap to money towards college.

Before we begin, let us take a look at “How America Pays for College”, a national study Sallie Mae, a student loan company, conducted for the year of 2017-2018. We can see a snapshot of this study in the diagram below.

Here are some key takeaways:

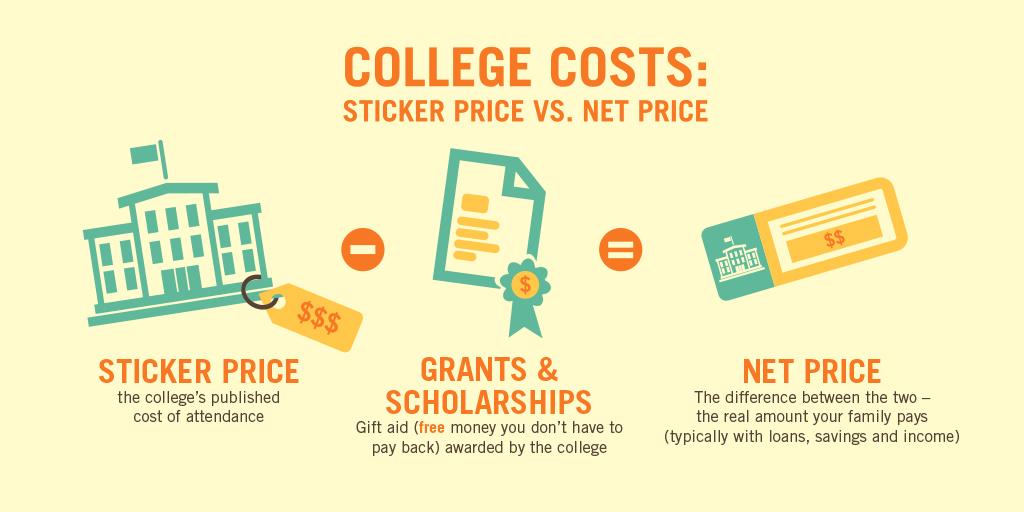

- According to this study, American families spent an average of $26,458 on college in the school year of 2017-2018. Almost half of this cost was covered using their income and savings. Scholarships and grants as well as student loans covered the other half.

- Additionally, over 50% of these families utilized scholarship or grant money, which we like to call free money towards your college education.

- Although each family’s paying for college strategy is different, 80% of them are confident that they made the right financial decisions for how to pay for college.

Why are we discussing this? To show you that, yes! It is possible to walk into college without the burden of financial uncertainty weighing down on your back.

Roadmap Towards a Cheaper College Education

We are going to now outline 5 essential steps to achieve our goal of paying for college the smart way. Ready to get started?

1. Complete your FAFSA

Completing the Free Application for Financial Aid will put you in the consideration pool for the greatest amount of financial aid from federal, state and college sources. As the name suggests, you can fill out your FAFSA for free.

This is probably the most important step in your journey towards paying for college. This is because your filled out FAFSA is a key element to receiving most types of aid such as:

- Scholarships

- Grants

- Work-Study jobs

- Loans

Needless to say, you should fill out your FAFSA regardless of whether or not you think you qualify for financial aid. The application is open on October 1st each year. Fill out as soon as possible because some colleges and universities offer aid on a first-come-first-serve basis. Remember, that you will need to resubmit your FAFSA each year.

2. Start Your Scholarship Search

We have outlined this process in greater detail in our Essential Guide to Applying for Scholarships.

Here’s a quick summary:

- Scholarships are essentially free money towards college education. You do not need to pay it back.

- You can start the scholarship search earlier than your senior year of high school. Moreover, you can continue the scholarship search well into college as well!

- Before you begin your search, you should take the time to create a scholarship strategy. This may include the creation of a master scholarship resume. Learn more about that here.

- You will need to form a scholarship team. This scholarship search team should consist of parents, mentors, educators, and anyone else who may have access tospecial scholarships based off of membership in associations or companies. Try to apply to local scholarships that the associations’ your team is affiliated with are offering.

- Research the core values, mission, and vision of the organization that is offering the scholarship you are applying to.

- Write a winning scholarship essay. More on that here.

- Reuse components of your scholarship applications to make the process go faster.

3. If You Qualify, Apply to Grants

Navigate to the Department of Education’s map of agencies across the nation that administer grants to students in different states.

When students fail to complete their FAFSA, they are essentially leaving behind billions of dollars that could be their’s if they are eligible for a grant. Do not make that mistake. Find the agencies in your state that administer these grants, check your eligibility, and look and apply for grants as you would with scholarships.

Again, remember that grants and scholarships are your two sources of free money towards college.

4. Get a Work-Study Job

A work-study job can be especially beneficial to the students who qualify for it. Not only does your work-study job provide a form of income, but it also gives you work experience and essential networking if it is related to your choice of major.

The federal work-study program funds these part-time jobs for eligible college students. Here is some essential information about a work-study job.

- You must fill out the FAFSA to be eligible.

- Although your financial award says you are eligible for the work-study program, it is your responsibility to secure a work-study job. In other words, you are not guaranteed the money until you have secured the job.

- According to the U.S. Department of Education, approximately 3,400 colleges and universities have a Federal Work-Study Program. Ensure that your colleges of choice offer this program by checking with their respective financial aid offices.

5. Evaluate Savings and Consider Loans

Realistically speaking, you will need to tap into your own savings when it comes to paying for college. As we mentioned earlier, most families cover half of the college tuition using their income and/or savings.

You will need to evaluate how much you will be able to financially contribute to your college education as well as the amount of money you will receive through scholarships and grants. If you are falling short, consider applying for federal loans. A good rule of thumb for choosing student loan plans are ones whose payments do not exceed 10% of your monthly after-tax income.

If federal loans do not suffice, then and only then should you consider applying for private loans. You must research this thoroughly before choosing a lender. Moreover, you must understand the financial burden you may be taking upon yourself as explained in this episode of Patriot Act with Hasan Minhaj below.

Good luck with paying for college! Let us know how your financial journey towards college progresses down below.